Research

Research

European Mid-Market Private Credit

This note explores why the current interest rate cycle makes now a “once in a cycle” opportunity for private credit, with core mid-market lending offering compelling, risk-adjusted returns amid rising competition.

Supermarket Rents

Supermarket Rents 101 – addressing the misconceptions around supermarket rents in the UK.

The note provides a history and overview of the UK supermarket leasehold space and the key considerations when calculating and assessing rents.

Atrato Analysis

Look beyond traditional asset allocation for long-lasting inflation-linked returns.

Despite the UK Consumer Price Index reaching a four-decade high, we believe the inflation peak is yet to come. Read our thoughts on portfolio positioning in an elevated inflationary environment.

Atrato Analysis

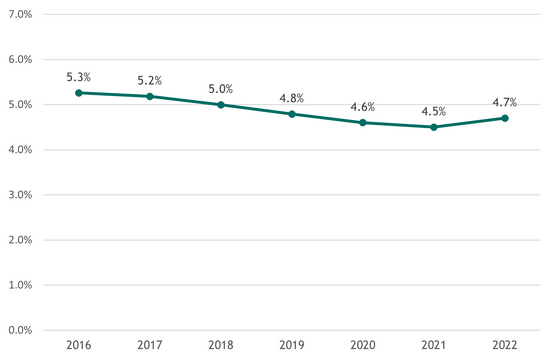

As sector specialists, Atrato Capital constantly monitors the transactional evidence of UK supermarket property assets changing hands.

In the absence of a representative index of transactions, we compiled our own data, the ‘Atrato Supermarket Yield Series’ showing the weighted average of individual long-leased supermarket transaction yields since 2016.

The yield series has been populated based on individual supermarket investment transactions which have over 10 years unexpired leases terms, benefiting from indexed linked or fixed uplifts and excludes open market rent reviews. All transactions in the series are valued in excess of £8.5m.

Supermarkets refer to any supermarket operated by mainstream grocery operators on any stores with a Gross Internal Area above 20,000 square foot. Yields have been calculated based on our understanding of the passing rent at the time of acquisition divided by the gross property value including a 6.8% adjustment for notional acquisition costs[1].

Yield impact quantifies the impact on capital values of a change in yields. If yields rise, capital values fall; conversely, if yields fall, capital values rise. A positive yield impact of say 10% would indicate that yields had fallen by such an amount as to increase capital values by 10%.

Atrato Capital - Watershed moment as online turns profitable for UK grocers

Can grocers now be truly agnostic

April 2021

The Covid-19 pandemic has driven five years of growth in online grocery in five months. This increased online penetration has transformed the profitability of omnichannel grocery fulfilment. With in-store and online profit margins now at near parity, omnichannel stores provide operators the benefit of achieving a seamless integration of customer experience across all channels.

We believe this underpins the importance of having the right stores in the right location to be successful in the future model of grocery.

Omnichannel Supermarkets - The future

of UK grocery

Key Findings

- Omnichannel supermarkets have emerged as the last mile grocery winners with locations adjacent to large catchments and minimal delivery drive times.

- Delivery cost is the dominant factor in online grocery fulfilment cost. Picking and packing productivity results in marginal gains.

- The near doubling in online grocery penetration has halved delivery costs from omnichannel stores.

- Grocery home delivery fulfilled from omnichannel supermarkets achieves materially better delivery density metrics when compared to centralised fulfilment centres (“CFCs”).

- Online grocery is now profitable for supermarkets with total fulfilment costs reduced to levels recoverable from customer charges.

- Store pick fulfilment productivity per labour hour is approaching equivalence to CFCs, but with a much lower capital cost.

- Adding online fulfilment operations to a supermarket creates a much better in-store experience with greater numbers of staff on the shop floor, increased product turnover leading to a fresher product on the shelves and availability of click and collect.

- Two of the major operators have abandoned their CFCs in favour of increased omnichannel store pick. CFCs will persist, but we believe only for operators with capacity constraints or in the premium price segment.